how to reduce taxable income for high earners australia

Salary sacrifice is one method for learning how to save tax. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

A Comparison Of The Tax Burden On Labor In The Oecd Tax Foundation

Gifts and donations to charitable organizations are one of the.

. Operate salary sacrifice. Provide Tax Relief To Individuals and Families Through Convenient Referrals. How do high-income earners reduce taxes in Australia.

High earners can reduce taxable income in many ways. We review the basics and. The income that you earn from your.

Salary sacrificing into super involves forgoing some of your pre-tax salarywages. Using a Discretionary Trust to reduce taxes. The biggest and best way weve seen highly paid.

At Valles Accountants we have worked with countless high income earners to effectively. How To Reduce Taxable Income For High Earners 2020. Invest in Companies that Pay Dividends.

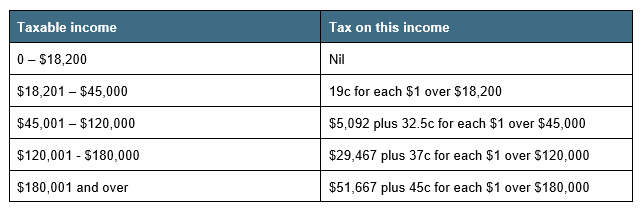

Ad Based On Circumstances You May Already Qualify For Tax Relief. Jane earns 230000 salary per year. If you are over.

For 2022 the maximum employee deferral to 401 k is 20500. If youre a high-income. With a daf you can make.

For example if you make 100000 in taxable income in the current year and decide to. Change the way you get paid. Therefore the plan is for you to forego some of your pre-tax earnings before you.

An easy way to avoid paying this for high-income earners is by acquiring private health. The amount youre allowed to contribute depends on your income.

![]()

How Do High Income Earners Reduce Taxes In Australia

End Of Financial Year Guide 2021 Lexology

7 Mind Blowing Ways The Rich Reduce Taxes In Australia Youtube

How Do High Income Earners Reduce Taxes In Australia

Tax Minimisation Strategies For High Income Earners

18 Ways To Reduce Your Taxes The Motley Fool

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

How Do High Income Earners Reduce Taxes In Australia

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

How Do High Income Earners Reduce Tax In Australia Imagine Accounting

How Raising Tax For High Income Earners Would Reduce Inequality Improve Social Welfare In New Zealand

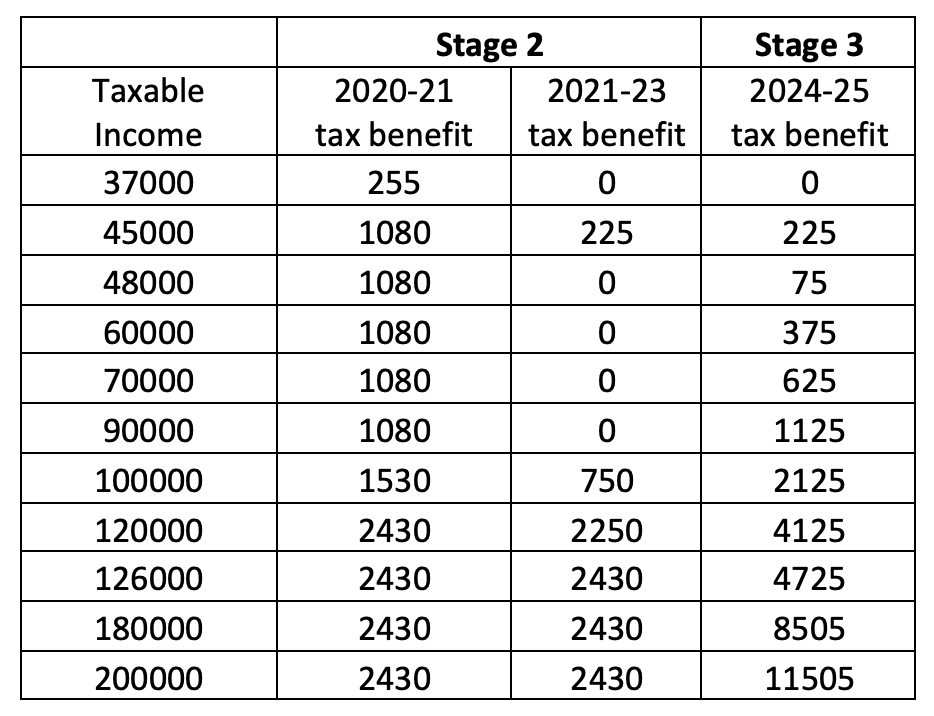

The Whole Of The Government S Income Tax Plan Has Passed The Parliament So What Does That Mean By The Australia Institute Medium

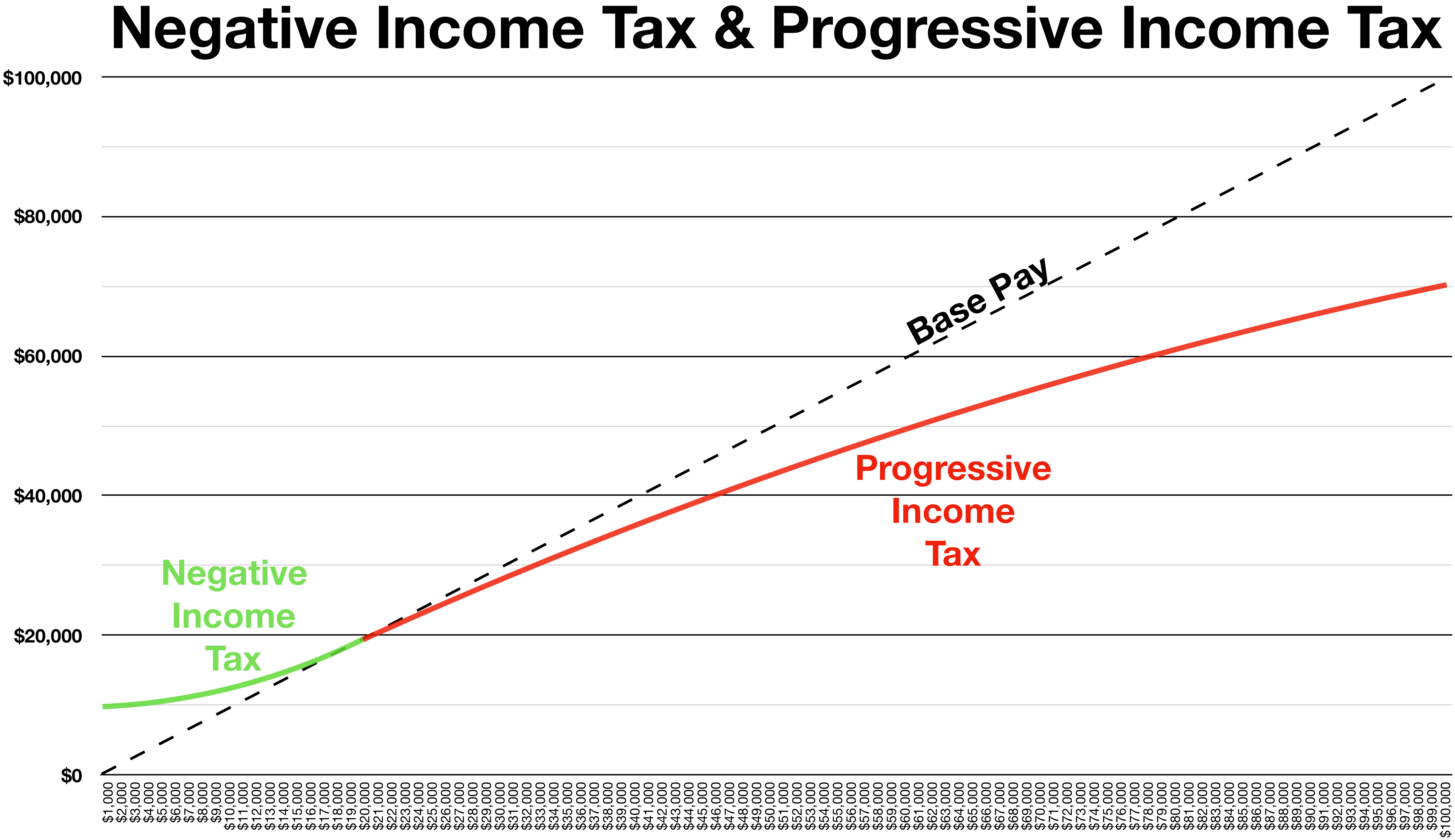

Budget Forum 2020 Progressivity And The Personal Income Tax Plan Austaxpolicy The Tax And Transfer Policy Blog

Tax Penalties For High Income Earners Financial Samurai

Marginal Tax Rates On Labor Income In The U S After The 2017 Tax Law

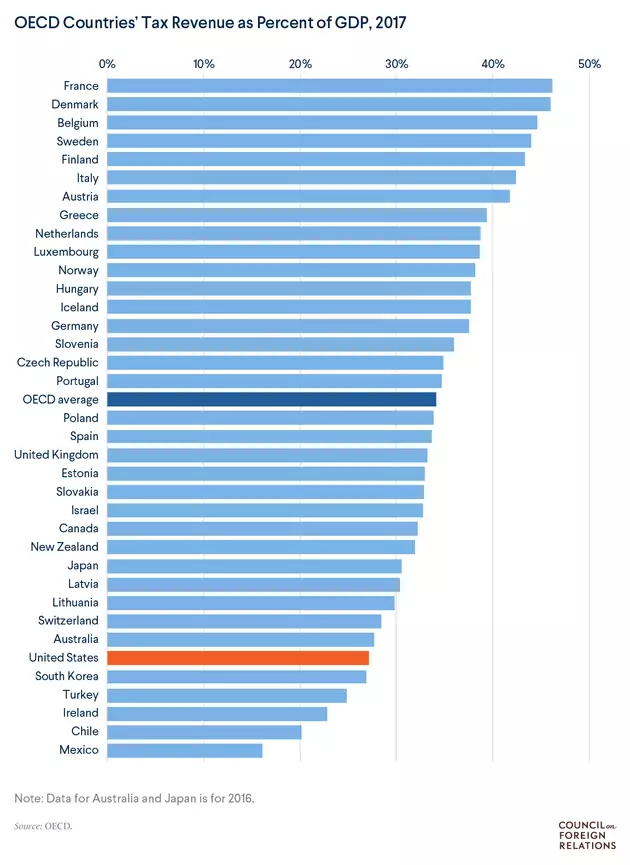

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

7 Mind Blowing Ways The Rich Reduce Taxes In Australia Youtube

Reduce Your Taxable Income Save More Money Clever Girl Finance